|

|||

|

|

|

||

|---|---|---|

|

||

|

||

|

||

|

||

|

||

|

||

|

|

|

|

Understanding the Best Refi Rates Today for HomeownersRefinancing your mortgage can be a smart financial move, but securing the best refi rates today is crucial to maximize your savings. In this article, we'll explore the factors affecting refi rates, the benefits of refinancing, and provide helpful resources. Factors Influencing Today's Refi RatesSeveral elements contribute to the fluctuation of refinancing rates:

Credit Score ImportanceYour credit score is a major determinant of the rate you'll receive. Lenders view higher scores as less risky, leading to more favorable terms. Benefits of Refinancing Your MortgageRefinancing offers numerous advantages:

Lowering Monthly PaymentsBy refinancing at a lower rate, you can significantly reduce your monthly mortgage payments, freeing up cash for other uses. For those in mortgage ocala fl, local lenders may provide competitive rates tailored to your needs. Finding the Best Refi RatesResearch is key to finding the best refinancing rates:

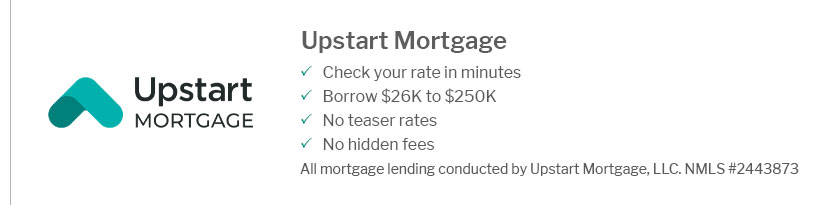

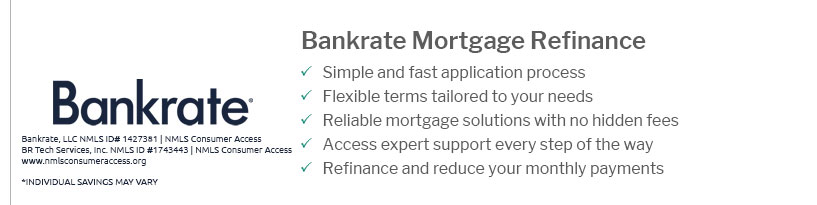

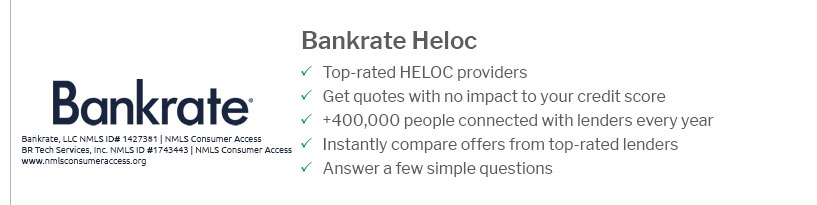

Researching LendersIt's essential to compare rates from different mortgage loan companies in usa to ensure you're getting the best deal. FAQSecuring the best refi rates today requires careful consideration of your financial situation and market conditions. By understanding the factors that influence rates and exploring your options, you can make an informed decision that benefits your financial future. https://www.chase.com/personal/mortgage/refinance-rates

We update the interest rate table below daily, Monday through Friday, so you have the most current refinance rates available. https://www.loandepot.com/refinance/rates

Mortgage refinance rates today can vary depending on a number of factors, and our licensed loan officers can answer your questions about home refinancing and ... https://www.zillow.com/refinance/

Additionally, the current national average 15-year fixed refinance rate remained stable at 5.98%. The current national average 5-year ARM refinance rate is ...

|

|---|